What I Do

Everything Begins With A

Well-Designed Financial Plan

At Retirement Portfolio Partners, I enjoy working with you to understand the big picture of your financial life, and then addressing the details that make the plan work – including identifying and resolving any gaps that may have previously been overlooked.

My personalized approach to wealth management includes an unwavering dedication to serving your best interests with services tailored to your needs. As such, I follow the steps below to discover your objectives and help you pursue them.

Proactive Financial Planning

The purpose of Financial Planning is to help you use, manage, and direct your resources towards what matters most.

Everybody has different goals and values. My personalized financial planning helps lay the foundation for a lifetime of smart financial decisions that meet your unique needs.

I advise on and help manage every aspect of your financial life. This allows me to fix problems before they become problems, as well as identify and take advantage of every opportunity that comes your way.

My focus is not on timing the movements of the market, but on crafting long-term plans to meet your goals.

When it comes to investing, your chief enemy is likely to be yourself. We are biologically wired to be poor investors of our own money.

A proactive, disciplined investment process is vital to ensuring that you capture market returns over the course of your lifetime.

Expert Guidance

Retirement Planning

My retirement planning services help you reach your goals without the risk of running out of money.

The retirement planning process includes:

Improving and tracking the success rate of your plan

Turning your retirement savings into a reliable paycheck

Developing a cohesive investment strategy to reduce risk and improve returns

Ongoing tax planning to reduce your tax bill

Aligning all the moving parts of your financial life to create a successful retirement

A retirement plan is a living and breathing document. I build your plan, track its success rate, adjust for life's unknowns, and communicate the results with you in plain English.

I help turn your nest egg into a sustainable income stream.

My approach is backed by decades of academic research and helps:

Keep your taxes low

Reduce costs

Maximize your investment return

Lower portfolio risk

Preserve your savings

The approach also takes into consideration your other income sources. Things like Social Security, Pensions, Rental Income, Required Minimum Distributions, and more.

Retirement Income

How do I turn my 401(k) into a paycheck?

Does the 4% rule apply to me?

When should I take social security?

Investment Management

My investment portfolios are carefully designed to help retirement investors reduce risk, improve returns, and create a sustainable income stream.

1. KEEP COSTS LOW

The best predictor of future returns is the cost of your investments. In other words, low-cost investments are expected to provide better returns than high-cost investments.

2. OWN TAX-EFFICIENT INVESTMENTS

Warren Buffet says his favorite holding period is forever. I agree.

To protect your investment returns and mitigate taxes, I target investments with low turnover.

3. OWN THE RIGHT ASSET CLASSES IN THE RIGHT LOCATIONS

Asset allocation is just as important as asset location. By putting high tax investments in tax-deferred or tax-exempt accounts rather than taxable accounts, you can potentially improve the overall tax efficiency of your investments.

Not all investments are created equal. Just because you can invest your money into something (Gold, Your brother’s new business idea, etc), does not mean you should.

Am I invested in the right way for retirement?

Am I paying too much?

What happens when the market crashes again?

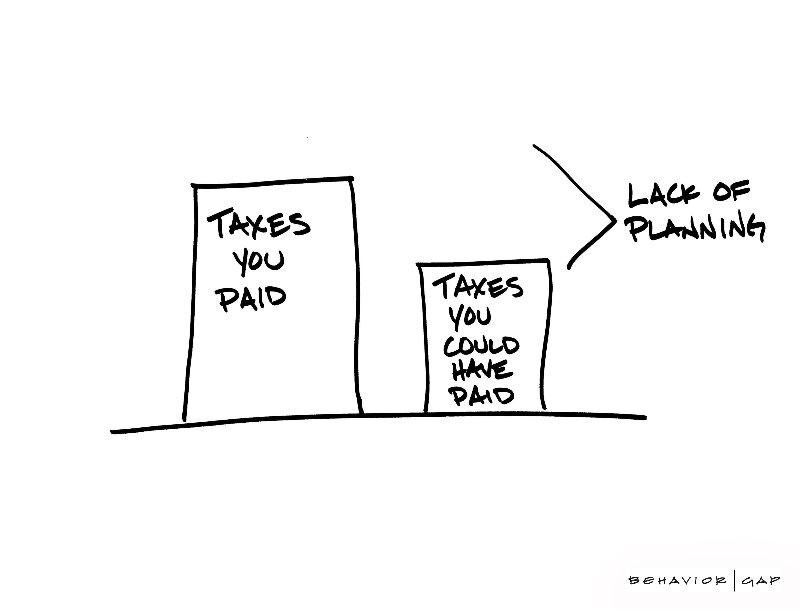

Without careful planning, it's very possible to have a higher tax bill in retirement than as a working professional.

My tax planning strategies aim to help keep taxes low today and in retirement. We accomplish this through:

Annual Tax Return Analysis

Annual Roth Conversions

Coordination & Timing of Income Streams (e.g. Pension, Social Security, Required Minimum Distributions, etc.)

Asset Location

Charitable Giving Strategies